Forecasts for Every Major World Market - FREE 120 Page Ebook

Get Your FREE Current Issue of Robert Prechter's EWI Global Market Perspective No cost or obligation You'll receive 120 pages of forecasts for every major market in the world, including global stock markets, interest rates, gold and silver, crude oil, currencies and more. You'll learn:

This offer contains timely market forecasts and will expire May 31st. We invite you to benefit from the current issue with no obligation. Be sure to download the current issue of Global Market Perspective Now. Regards, EWI About the Publisher, Elliott Wave International

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone this link To update your preferences this link How to Unsubscribe - this link

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. | |||||||||||||

DSD Removals and Storage

Wednesday, 18 May 2011

Forecasts for Every Major World Market - FREE 120 Page Ebook

Tuesday, 17 May 2011

Bank of England's Phony Inflation Panic, Greece Bankrupt Again, Silver Crash 2011

Bank of England's Phony Inflation Panic, Greece Bankrupt Again, Silver Crash 2011Stocks Stealth Bull Market 2011 Ebook Direct Download Link (PDF 2.8m/b) Interest Rate Mega-Trend Ebook Direct Download Link (PDF 2.3m/b) Inflation Mega-Trend Ebook Direct Download Link (PDF 3.2m/b) Dear Reader The week saw the Merv (Britain's version of the Bernank) step forward and utter excuses as to why he now expects UK inflation to 'temporarily' soar above 5% this year on the official CPI measure (that significantly under reports real inflation as experienced by the general population). Mervyn King in a smoke and mirrors presentation all but blamed speculators for the surge in commodity prices with expectations that UK energy prices would surge by 15% later in the year. So I guess after spending the whole of 2010 pumping out always temporarily high inflation now the Bank of England is getting ready for shock and awe 5% CPI inflation statements, add to this the Deputy Governor of the Bank of England going on to blame speculators for the surge in commodity prices, and intends on wasting millions in tax payers money by taking part in an international study into the impact of commodity price speculation on inflation. All of this is smoke and mirrors propaganda, why ? Because the Government / Bank of England Wants / Needs HIGH Inflation, and has done so since the start of the financial crisis several years ago, as I will illustrate in this article, high real inflation remains the ONLY response that the Government and it's central bank have to deal with Britain's debt crisis (ever increasing debt mountain) as the alternative is to go down the same path as bankrupting Greece of a deflationary spiral, it's just that the powers that be perceive (correctly) that an inflationary spiral as being more palatable to the electorate / general population as they have nominal statistics thrown at them that paint a picture of everything getting better when the truth as personally experienced is the exact opposite in real terms. The Bank of England also downgraded the UK economies GDP growth forecast for 2011 to 2%, down from 2.8% which is trending towards my forecast as of August 2010 (UK Economy GDP Growth Forecast 2010 to 2015 )that the UK economy would grow by 1.3% this year. UK Inflation Forecast 2011 The updated in-depth analysis and forecast for UK inflation for 2011 (17 Jan 2011 - UK Inflation Forecast 2011, Imminent Spike to Above CPI 4%, RPI 6% ) concluded in UK inflation spiking to a high of 4.2% early 2011, and thereafter trend lower towards 3% by the end of 2011 and therefore remaining above the Bank of England's 3% upper limit for the whole of 2011. This weeks Bank of England Inflation Report now forecasts UK CPI of 4% by the end of 2011 which represents a sizable jump from the last report of 1.7% by the end of 2011.

Continuous Loss of Earnings Purchasing Power If Britain's working and middle classes were not being squeezed enough by persistently high inflation that is currently eroding purchasing power of earnings at the rate of 3.5% per annum (RPI-Earnings), are now also being increasingly hit by a series of tax rises and benefit cuts that collectively look set to erode average purchasing power by between 15% to 25% over the next 2 years, after having already suffered negative earnings for the past 3 years as illustrated by the below graph.

UK Interest Rate Forecast 2011

The recent (March 2011) 85 page Interest Mega-Trend Ebook (FREE DOWNLOAD), concluded in expectations for 1 or 2 token UK rate hikes with the first rate rise expected to occur in June / July 2011, and longer term expectations for UK interest rates to hit a minimum of 4.5% by the end of 2014.

The Inflation Mega-trend The bottom line is that the central banks CREAT inflation by means of PRINTING MONEY (in its various forms from fractional reserve banking to Quantitative Easing), if they did not print money then there WOULD BE DEFLATION, as that is NORMAL for a stable monetary environment as technologically development would result in FALLING PRICES, but the central banks cannot STOP printing money as that is the primary means of TAXING 99% of the population. We are living in a decade of high inflation that was covered at length in the January 2010 100 page Inflation Mega-Trend ebook (FREE DOWNLOAD), that contains 50 pages of analysis and 50 pages of wealth protection strategies. Western governments such as the UK and USA are printing their way out of their fiscal crisis whilst emerging markets have soaring demand for commodities, goods and services and are exporting their inflation abroad so as to prevent their populations from revolting over ever higher food prices. The Bank of England remains paralysed by the fear of another banking sector financial armageddon, and is continually pressured by the UK government that seeks high inflation as a means of making stealth deep real terms cuts in public spending, the deficit and total accumulated debt, thus the British economy is being sleep walked towards a wage price inflation spiral, as people will increasingly refuse to be lied to anymore and start to demand wage rises in line with real inflation. Look the facts are as illustrated in the UK Sunday Times Rich List which saw the wealth of the 1000 richest people in Britain increase by 18% over the past year whilst ordinary people have seen the purchasing power of their earnings shrink by an average of 3%, a lot of smoke and mirrors have to be utilised by these 1000 ruling Oligarch's to ensure that the masses do not revolt but instead are forced to pay higher taxes and have their savings inflated away as the super rich Oligarchs DO NOT pay the same rate of tax and evade the consequences of inflation stealth tax by means of central banks funneling cash through various means into their back pockets such as the inflating of stock prices by 100% in 2 years, and the situation is even worse in the United States. Bank of England's Worthless Inflation Reports Propaganda High UK Inflation that has apparently surprised everyone to the upside for virtually the whole of 2010, by spiking and remaining above 3% from early 2010 illustrates the tendency of the mainstream press to basically regurgitate the views of vested interests that have beaten the drum of always imminent DEFLATION for the whole of 2010 as High inflation was always just temporary and should be ignored by the general population. To look at the reason why high inflation has been ignored during 2010 we have to look beyond journalists, we have to look beyond academic economists that are paid to follow a school of thought that their pay masters want to push in the media. The place to look for the reason why high Inflation is being ignored is to the very top of the financial pyramid, to the Bank of England. The connection that the mainstream press has never been able to make is that the Bank of England does NOT make Forecasts. Instead the Bank of England quarterly inflation forecast reports are nothing more than ECONOMIC PROPAGANDA, that virtually always converge towards the Bank of England achieving its 2% Inflation target in 2 years time, despite the fact that historical analysis shows that the Bank of England FAILS in achieving its 2% target 96% of the time. The following are the last 6 quarterly Inflation forecast reports by the Bank of England issued from February 2010 to May 2011 that were instrumental in academic economists and journalists in the mainstream press regurgitating the always temporarily high inflation mantra during 2010 and into 2011, despite current CPI of 4%. Bank of England February 2010 Inflation Report

UK Inflation by Feb 2010 had as I anticipated spiked to above 3% (27 Dec 2009 - UK CPI Inflation Forecast 2010, Imminent and Sustained Spike Above 3%). However the Bank of England's Feb 2010 Inflation Report forecast the spike as being temporary and to imminently resolve in severe disinflation to target a rate of below CPI 1% by December 2010, instead actual UK Inflation for December was 3.7%. The forecast for end 2011 was just 1.2%. Bank of England May 2010 Inflation Report

The May 2010 Inflation report continued with the mantra of temporarily high inflation that would resolve in a rate of about 1.7% by the end of 2010, on the basis of spare capacity in the economy, the blatant flaw in the Bank of England's argument is the fact that much if not all of the spare capacity had been destroyed during the Great Recession of 2008-2009. The forecast for end 2011 was now revised to 1.3%. Bank of England August 2010 Inflation Report

The mantra of spare capacity, downward pressure on wages to resolve in disinflation continued in the August 2010 Inflation Report. However now with most of 2010 gone, The CPI target for 2010 was revised higher to 3% from 1% (Feb 2010), with CPI for 2011 forecast to resolve to 1.2%, and a sub 2% CPI in 2 years time. Bank of England November 2010 Inflation Report

The Bank of England's November 2010 Inflation Report (November 2010) forecast UK CPI Inflation to target an early 2011 peak of 3.5% before inflation falls to approx 1.7% by end of 2011, and for inflation to remain well below 2% into the end of 2012, therefore supporting the Bank of England's persistent view that everyone should focus on the Deflation threat and ignore high inflation during early 2011 so as the Bank of England can continue to keep interest rates well below the real rate of inflation for the purpose of funneling savers and tax payers cash onto the balance sheet of the bailed out banks. Bank of England February 2011 Inflation Report

The Feb inflation report (Feb 2011) revised the for forecast for UK Inflation for end 2011 to approx 2.3% and yet again UK inflation in 2 years time would conveniently fall to below 2% and therefore the real threat remained DEFLATION. Bank of England May 2011 Inflation Report

The current inflation report (May 2011) has now revised for UK Inflation for end 2011 to approx 4%, compare that against a range of between 1.2% and 1.7% pumped out as deflation mantra during the whole of 2010. As ever the ongoing rise in inflation is deemed to be TEMPORARY with UK inflation, you guessed it, to again as if by magic converge to below 2% in 2 years time, now forecast to target 2% by the end of 2012. Can You See through the Bank of England Inflation Forecasts Smoke and Mirrors? The Bank of England's Inflation reports clearly illustrate the persistent trend as was the case for virtually every preceding year in that the Bank of England ALWAYS FORECASTS SUB 2% INFLATION in 2 YEARS TIME. The inflation graphs clearly show that actual inflation tends to be significantly above the BoE's forecasts and usually by a wide margin of as much as 2.5%, with the 1 year forecasts in even greater error that supports my long held view that the Bank of England's Inflation forecasts are nothing more than economic propaganda so as to make the Banks job easier in managing monetary policy, especially as the Bank of England remains terrified of another potential Banking Sector induced Financial Armageddon. The bottom line is that those at the helm of the economy and in charge of managing inflation / growth by their public statements imply that don't have a clue as to what is actually driving inflation today, instead they make rear view mirror looking statements of yesteryear and extrapolate into the present. The reason why we have high inflation is because the world has 7 billion and growing hungry mouths to feed, then throw into the equation some 300 million newly created middle class Chindian's (China+India), that is growing at an estimated 40 million per year, all with the same appetites as those in the west, then its not just the UK that has an inflation problem but the WHOLE WORLD ! Welcome to the GLOBAL Inflation Mega-Trend. So I am afraid the apparent fools sat around the Bank of England's MPC table (collecting fat tax payer funded pay cheque's) will only realise this perhaps 2 years down the road when so called temporary high inflation passes its 3rd anniversary. If the Coalition government were serious about managing the economy and solving Britain's economic and inflation crisis then the first step they should take is to fire ALL of the members of the MPC! Greece Goes Bankrupt Again, Demanding Another Bailout The Eurozone piling more debt on top of PIIGS existing debt mountains as economies contract, such as Greece contract under the weight of economic austerity all without the mechanisms of stealth default by means of high real inflation (debasing ones currency) has always ensured that debt default for many countries such as Greece is INVETABLE. I covered many of the solutions being voiced in the mainstream press today as Greece leaving the Euro over a year ago(11 May 2010 - E.U. $1 Trillion Bailout, Detonates Nuclear Option of Printing Money to Monetize PIGS Debt). Financing albeit shrinking annual PIGS deficits over the next few years will still mean that ALL of these countries debt burdens will be HIGHER in 3 years time, i.e. Greece's debt burden is expected to rise from 120% of GDP to as high as 150% of GDP. How is that a solution for the debt crisis? How will that prevent eventual debt default ? Answer - It won't! The ONLY solution is for the Eurozone economies to GET their economic houses in order which means cut the deficits and total debt as a % of GDP which can only be achieved through economic growth which means public sector spending cuts and reform of economies to generate economic growth that means LESS E.U. and national regulation as touched up on in the article Solving Britain's Economic Crisis Through Micro Business Capital Investments and Credit (31st Mar 2010). However when a country has a debt burden of 120%+ of GDP at interest rates of 5% or higher the inevitable result is still debt default. EURO II ? This, first of a series of money printing debt monetization bailouts puts the Euro firmly on a trend towards high inflation as are all fiat currencies, i.e. the fundamentals of the Euro block composed of many small weak economies that cannot devalue internally against highly competitive strong economies will still remain. The only possible solution is for a Euro II, i.e. split the Euro into two currency blocks one for the weak that suffer higher inflation and interest rates and the more competitive countries as part of the Euro II block (could just be Germany on its own?) which would act as a safety valve in times of economic crisis that demands internal currency devaluations. Now a year on from the last bailout and a matter of days after bailing out Portugal, Greece has progressed further on the road towards outright default as the economy deflated by 4.8% over the past 12 months whilst it saw prices inflate by 3.9%. Therefore all the Eurozone can do is to work towards another bailout in an attempt to again delay the inevitable, and so to speak kick the can down the road. The closer Greece gets towards defaulting on its debts (restructuring) then the greater will be the pressure Greek and other European Banks are put under as investors flee in the face of another series of investor wipeout bailouts as have occurred during the past 3 years. As ever the risk of banks going bankrupt and taking savers depositors down with them remains which still means that UK savers need to ensure that they do not deposit more than £85k (compensation limit) with any one banking group as I covered at length in a November 2010 article - Protect Savings & Deposits From Banks Going Bankrupt! Meanwhile panicking eurozone politicians continue with the propaganda of no default under any circumstance for Greece as illustrated by comments from the French Finance Minister Christine Lagaard - We are ruling out default in any form, There's no question either of Greece leaving the European Area. I want to reassure investors. Which translates into that there WILL be another bailout for Greece, and then possibly another one after that, but a Greek default is CERTAIN, why ? because the alternative is that the whole country will be owned by foreigners ! A stealth conquest of Greece by predominantly German and French banks. Which appears to be the consequences of the single European currency, that all assets each Eurozone country owns are slowly gravitating towards being owned by mainly Germany. Britain is Not Greece, Portugal, Ireland or Spain. This is why whilst Britain's budget deficit is greater than that of Portugal's but its debt interest rates are on par with that of Germany, as the risk of outright default is significantly lower (at this point in time) and I am sure that the Euro-zone is grateful that the UK is not part of it, for it if where then France and Germany would probably have had to have bailed out Britain! In fact given the size of Britians private and public debt mountain that is more than £5 trillion, the Euro would probably have been ripped apart a year ago if Britain had been part of it as a bailout of Britain would have bankrupted France and Germany, instead the workers and savers of Britain are paying 100% of the price. However, whilst the financial & banking system picture may appear more stable in the UK as long as economic austerity measures are seen to being implemented to stabilise debt to GDP, this does mean as illustrated earlier in this article that 80% of the population that represents the working and middle classes will pay a very heavy price for the stealth debt default by means of high inflation as the purchasing power of earnings and savings are eroded away, representing a loss of upto 25% of the purchasing power of their earnings over just 2 years (the very poor on benefits and the super rich evade most of the consequences of economic austerity and high inflation). The pain WILL be increasingly real and unprecedented, and I expect it to hit peoples most prized asset class hard despite high inflation, which is the Housing Market, more on this in a series of articles that will conclude towards a detailed trend forecast for UK house prices for several years which aims to replicate the accuracy of past housing market analysis such as the August 2007 that called for a 2 year bear market into August 2009 (UK Housing Market Crash of 2007 - 2008 and Steps to Protect Your Wealth ). The bottom line is that nothing has changed, no debt has been repaid or likely to ever be repaid which means the debt burden today is greater than a year ago and will be greater still a year from now, the same holds true for virtually every western country. Britain remains on the public debt trajectory as last analysed in June 2010 (UK ConLib Government to Use INFLATION Stealth Tax to Erode Value of Public Debt ) and little different to that which the country would have faced under a Labour government, which is for a 50% rise in public debt on 2009-2010 by 2013-14.

Which is why Inflation was, and is the ONLY response that the government / central bank has to reduce the growing debt mountain's value in real-terms, else the UK would be exactly where Greece and the other PIIGS are today, facing outright default and bankruptcy as a consequence of contracting economies and growing debt mountains.

The governments primary objective is to stabilise debt as a percentage of GDP, which the June 2010 analysis confirmed is possible given an environment of high inflation for many years and economic austerity that will contribute towards restraining the previous Labour government's exploding debt mountain in real terms, as it caps spending budgets in real terms as well as inflating away the value of debt by a good 4-5% per year as nominal GDP is inflated thus giving the population the illusion of economic growth something that the PIIGS governments are unable to do. So, remember that whatever propaganda the government or the Bank of England pumps out concerning temporary high inflation that is always destined to fall, that is NOT possible given the primary objective for stabilising debt to GDP, without which market interest rates would be more than double where they are today and Britain would be facing an out of control debt interest spiral along which lies an hyperinflationary economic collapse as people lose confidence in holding sterling. That is the big picture, of stabilising Debt to GDP before it takes off into the stratosphere. Therefore, under these circumstances, as I covered at length in the Inflation Mega-Trend Ebook, a low inflation environment is just NOT possible, Inflation will NOT be at 2% in 2 years time as the Bank of England keeps pumping out, it will remain at at least twice that level for at least the next 4 years and probably longer still given the fact that the Coalition Government will aim to create in illusory inflationary boom in the run up to the next general election in 4 years time. Silver Crash 2011 Probably Not Over It looks like most silver bugs got swept away by the bullish hysteria that is associated with parabolic moves, with outlandish forecasts emerging just as silver was peaking at $49, forget $75, $100 was just a matter of weeks away when the resulting reality was that of a 33% price crash to below $34.

My quick take as someone who is watching from the side lines is that the silver price ran way ahead of itself when compared against the Gold price (See Inflation Mega-Trend Ebook analysis on the Gold / Silver Ratio), in fact it STILL remains expensive when compared against Gold, so on a fundamental basis I can't see a sustainable run up in the silver price on the horizon. If anything we could see Silver after a short-term bounce to $40 from technically oversold levels trade to below $30 and lower still if the Gold price also significantly weakens. So Silver bugs, despite the 33% crash, Silver is still not cheap relative to gold, keep your eye on the gold price, and don't get married to your positions as Silver has always been one of the most volatile markets to trade, and given the relatively mild reaction in the Gold price which suggests that is where precious metals investors should be focused. Source and Comments: http://www.marketoracle.co.uk/Article28153.html By Nadeem Walayat Copyright © 2005-2011 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of three ebook's - The Inflation Mega-Trend; The Interest Rate Mega-Trend and The Stocks Stealth Bull Market Update 2011 that can be downloaded for Free. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone this link To update your preferences this link How to Unsubscribe - this link

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. | ||||||||||||||

Tuesday, 10 May 2011

Welcome to our Newsletter

Please keep this email for later reference.

Your email address has been added to the following newsletter(s):

*Market Oracle Newsletter

To update your details and preferences please go to

http://www.marketoracle.info/?p=preferences&uid=c6dac89b760f91c70b3b9ca3b16db2a7.

If you do not want to receive any more messages, please go to

http://www.marketoracle.info/?p=unsubscribe&uid=c6dac89b760f91c70b3b9ca3b16db2a7.

You can access the newsletter archive (delayed updating) here -

http://www.marketoracle.co.uk/Topic19.html

The Stocks Stealth Bull Market Update 2011 Ebook download - (2.8meg) -

http://www.marketoracle.co.uk/pdf-1016/Stocks-Stealth-Bull-Market-2011-by-Nadeem-Walayat.pdf

The Interest Rate Mega-Trend Ebook download - (2.2 meg pdf) -

http://www.marketoracle.co.uk/pdf-a/The_Interest_Rate_Mega_Trend_Ebook_by_N_Walayat.pdf

The Inflation Mega-Trend Ebook download (3.2 meg pdf) -

http://www.marketoracle.co.uk/pdf-1016/The_Inflation_Mega-Trend_Nadeem_Walayat.pdf

Thank you

Sarah Jones

Site Administrator

http://www.marketoracle.co.uk

Wednesday, 4 May 2011

Obama Kills Osama After the Bernank Spoke, US Dollar Bubble Bursts Trending Towards USD69

Obama Kills Osama After the Bernank Spoke, US Dollar Bubble Bursts Trending Towards USD69Stocks Stealth Bull Market 2011 Ebook Direct Download Link (PDF 2.8m/b) Interest Rate Mega-Trend Ebook Direct Download Link (PDF 2.3m/b) Inflation Mega-Trend Ebook Direct Download Link (PDF 3.2m/b) Dear Reader What a week! A series ever more historic events accompanied by the dollar's continuing in the background meltdown. Firstly, the Bernank spoke, spouting more central bank propaganda which as expected has been liberally lapped up by the mainstream financial press and further regurgitated at length by the BlogosFear, after all talk is cheap when compared with the increasing costs of actually doing something. The facts are that the vast majority of academics and financial press talking heads have been wrong on QE since it started in March 2009, who recently with the benefit of hindsight have been stating that the rally in stocks and commodities has been purely as a consequence of QE1 and QE2, despite the fact that many of these same commentators had during 2009 been stating that QE would NOT be able to prevent DEFLATION and stocks and commodities would FALL as a consequence of what amounts to perma deflation propaganda, additionally many had stated during early 2010 that QE had come to an END and that there would be NO QE2 (Google their name + QE 2009 / 2010). Of late many of these deflationistas' have been attempting to reinvent themselves with the benefit of hindsight of a 100% run up in stock prices that they have not only missed but have been actively advocating the betting against to recognise aspects of the Inflation Mega-trend in a luke warm manner as they are in unable to abandon the red herring theory of debt deleveraging deflation as I warned of right at the start of the current phase of the Inflation Mega-Trend in November 2009 (18 Nov 2009 - Deflationists Are WRONG, Prepare for the INFLATION Mega-Trend ). Why do deflationists have it wrong ? It is that focusing on the deleveraging of the the debt mountain is a red herring, taken on its own then yes it DOES imply deflation as the debt bubble 'should' contract. But given the asset price reaction of 2009 that is NOT what is actually taking place! the Debt bubble is NOT deleveraging, the bad debts are being dumped onto the tax payers! The huge derivatives positions that act as the icebergs under the ocean as compared to the asset price tips that we see above water are not contracting but expanding! The actual reality of the so called great deflation of the past 2-3 years is revealed by the below graph for US CPI inflation that makes a mockery of such deflation commentary that amounts to nothing more than perpetuating central bank propaganda.

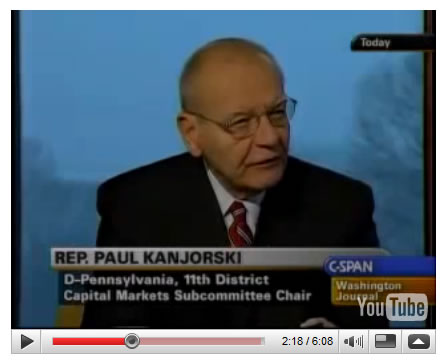

And don't forget that real inflation is probably between 50% and 100% higher than the official inflation rate as my research on UK inflation has revealed, which would lift the current U.S. official CPI inflation rate of 2.7% to between 4% and 5.4% as more reflective of the general populations actual inflation experience. Bernanke's Latest Deflation Propaganda Money Printing Speech Prior to the speech there was much speculation from the talking heads that Bernanke would be announcing an end to QE2, my view on QE money printing has remained constant for several years now in that once overt money printing starts it cannot end whilst large budget deficits persist which means that QE3 will soon follow the scheduled end of QE2 in June. The strategy remains for the central bank to play its part in inflating public debt away by means of high real inflation that erodes purchasing power of wages and lifetime accumulated savings and wealth as covered at length by the 100 page Inflation Mega-Trend Ebook of January 2010 (FREE DOWNLOAD). Therefore I expected Bernanke to continue to pump out deflation propaganda such as focusing on core inflation that excludes food and energy costs because off course everyone has stopped feeding and heating themselves, so as to allow the Fed to continue with the stealth debt default of US Debt by means of high real inflation. As I have stated several times during the past few years, IGNORE central bank propaganda statements on QE ending, or not continuing because it is a LIE, there WILL be QE3, no matter what the Fed says as the Fed statements are nothing more than economic propaganda focused on managing the general populations inflation expectations. The facts are that QE3 has effectively already begun! One only needs to look at the series of ever more desperate money printing announcements coming out of Japan to see what lies in store for the U.S., as the default fall back position in the face of any financial or economic adversity is for every central bank to press the print money button, where QE is just one manifestation of. The bottom line where the markets are concerned is that QE has always been one element that is driving the bull markets in stocks and commodities because the whole system is geared towards incentivising people and investors to spend and speculate rather than save as the alternative is financial armageddon, which is something that all central banks remain petrified of, and therefore anything, including 10% real inflation rate is better than total economic collapse that would fast follow a collapse of the bankrupt banking system as nearly occurred during September 2008 as the following video illustrates just how close the U.S. financial system came towards total collapse ( Excerpted from the Interest Rate Mega-Trend Ebook - FREE DOWNLOAD). At 2 minutes, 20 seconds into this C-Span video clip, Rep. Paul Kanjorski of Pennsylvania in February 2009 explains how the Federal Reserve told Congress members about a "tremendous draw-down of money market accounts in the United States, to the tune of $550 billion dollars." According to Kanjorski, this electronic transfer occurred over the period of an hour and threatened a further $5 trillion to be drawn out triggering a total collapse of the Financial System, which prompted Hank Paulson's emergency $700 billion TARP bailout action. Video Served by Youtube Bernanke says he fears that QE3 will do more harm than good in terms of inflation, but as I wrote in the Stocks Stealth Bull Market Ebook, it's too late, the harm has already been done with QE1 and QE2, the inflation time bomb is already going off, which is further enhanced as a consequence of the falling dollar. The QE Bull / Bear Debate Where the markets are concerned The QE debate boils down to two fundamentals positions of those that are riding and profiting from the stocks and commodities bull markets against those of perma-bear persuasion that not only consistently miss whole bull markets but give up all of any gains they may have made during preceding bear markets. This factor encompasses 99% of the debate that goes on across the Blogosfear. Now whilst some may conclude that it is a case of perma-bears arguing against perma-bulls, however that is not quite accurate for in a bull market Investors SHOULD be a BULL, likewise in a bear market, investors should be bears, because that is how one preserves and grows ones wealth and not by betting against EITHER bull or bear markets. Whilst Everyone now several years on with the benefit of hindsight recognises the importance of QE, though in simplistic and in herd like instincts elevated to exclusivity status when in actual fact it is just one of many possible HINDSIGHT reasons that can be used to explain market price action AFTER the fact much as I suggested would occur right at the birth of the stocks stealth bull market in mid March 2009 (15 Mar 2009 - Stealth Bull Market Follows Stocks Bear Market Bottom at Dow 6,470 ). A. The markets move ahead of the economy, whilst I don't profess to know the EXACT reasons of why they will move AHEAD until that becomes apparent AFTER the market has already moved, however I do have some reasoning in that INFLATION, Zero Interest Rates (Forcing savers / financial institutions to take risks) Quantitative Easing (money printing), and HUGE Fiscal stimulus packages that are laying all of the ground work for the next bubble regardless of how bad things appear as any outcome that prevents another Great Depression will be seen as bullish! i.e. even a low growth high inflation stagflationary environment WILL be seen as a positive outcome against the present day data that points to a collapse of global demand on a scale not seen since the Great Depression. The governments HAVE learned the lessons from the Great Depression and WILL succeed in inflating the asset prices and ignite the next perhaps even bigger bubble, meanwhile the stealth bull market will continue which by the time everyone realizes what's going on stocks will already by up by perhaps more than 50% from the low. More on QE as excerpted from the recent Stocks Stealth Bull Market Ebook Download Now-(PDF 2.8meg), the only requirement is a valid email address. Quantitative Easing AKA Money Printing U.S. politicians are living in fantasy land where they think they can get away with printing money and debasing the dollar without any consequences, they either do not care because they have become rich on the cash funneled to them by their bankster masters who they serve, or that they are delusional, completely detached from the real world. Many countries in the past thought the same, Germany, Russia, Italy, Zimbabwe to name a few and they ALL economically collapsed leaving the holders of their currencies with worthless paper to sell on ebay as high denomination trinkets, though off course the US dollar has already lost over 90% of its value during the past 100 years as a consequence of the stealth debt default through Inflation. The stealth theft of wealth by means of high real inflation has been getting another accelerant these past 2 years ( in addition to public debt and POMO) in the form of direct money printing (electronic) by the US Fed to the tune of $2.3 trillion to first buy mortgage backed securities and then monetize the U.S. budget deficit that comes in at an annual $1.5 trillion and likely to continue at approx 1.5 trillion a year for a decade, that requires direct purchases by the Fed because no one else is dumb enough to buy the literal flood of paper, in fact now over 70% of new debt issuance is purchased by the Fed with most of the rest by other money printing central banks. Whilst $2.3 trillion may not sound like a lot given the size of the approx $15 trillion annual GDP U.S. economy, but we are living in a fiat currency world where fractional reserve banking allows the banks to create credit at more than X10 the electronic print run and many, many times more during the pre-credit crisis credit boom. Where's the money gone ? Well not much into loans to main street but it has into assets on leverage such as commodities and stocks and off course the Fed's bankster brethren making over a trillion in risk free profits on buying US government backed bonds such as Treasuries and mortgage backed securities, U.S. tax payer funded profits without risk. This is why the past year has seen virtually every analyst jump on board the QE bandwagon as a rear view mirror explanation for why stocks have soared, though backtrack to Feb / March 2009 and quite a number of these same so called analysts were explaining at length why QE meant that stocks would NOT RISE ! (Google it). Worse still, a year into the stocks stealth bull market trend (March 2010) these same analysts were excitedly stipulating that the Fed had indicated that QE had come to an end and had started to unwind its positions and therefore implying that the so called bear market rally was over, following which along came the start of QE2 in November 2010, these same analysts are now suggesting that there will be no QE3. No wonder 90% of traders and many investors are on the losing end of trends because approx 95% of what they are reading is garbage pumped out by nothing more than sales men, academics, journalists or frankly media whores. The record is all there on Google to be confirmed within a minute or so. So as I say ALWAYS say, research each analysts past record before you pay any attention to their most recent diatribe. For it is always easy to pump out propaganda in support of ones pre-existing perma-view usually pushing sales but infinitely more difficult to arrive at a probable trend conclusion. So whilst so called analysts had convinced themselves during early 2010 that QE had come to an end. However my conclusion has remained the same for over 2 years now that once Quantitative Easing starts it CANNOT END whilst large budget deficits exist regardless of what the central bankers publically state, as their focus is in massaging the expectations of the general population and financial markets with regards positive expectations on the economy and inflation and NOT in publicising accurate projections, as that would make their jobs much harder as I elaborated upon during mid 2010 (13 Aug 2010 - The Real Reason for Bank of England's Worthless CPI Inflation Forecasts ). The facts are and have remained for two years now that QE is INFLATIONARY (which is why I termed it as Quantitative Inflation in March 2009), which ultimately means HIGHER Commodity Prices ($ oil is not soaring just because of political unrest), Consumer Prices, Asset Prices and eventually Interest Rates (covered in the bonds section). Though it's not just the U.S., ALL countries are at it, any economic problem and they press the print money button because it is far easier politically to print money (stealth theft of purchasing power) then to raise taxes / interest rates. The whole point of QE money printing asset buying was to generate economic growth by means of boosting the wealth effect. What the central bankers such as the Fed and BoE never factored into their formulae's was that their bankster brethren would use the cheap money to buy commodities on leverage rather than make loans to main street, hence sending asset and commodity prices soaring well beyond even the real inflation rates of between 7% and 9%, despite the fact that they did the exact same thing during mid 2008 to crude oil. Yes there is a wealth effect for the bankster's and the few who have been able to bite the bullet and get on board the stocks stealth bull market and commodities, with prices being inflated by bankster's courtesy of central bank easy money. Inflation Time Bomb - Each QE builds up inflationary pressures in the U.S. economy that act as a ticking time bomb primed to go off, I cannot over state how inflationary QE is for an economy, even if QE stops at $2.3 trillion (which I doubt) then that pressure will remain, the ignition for it will probably ironically lie with rising short-term interest rates because QE induced near zero short rates have actually acted to suppress economic activity as the expanded Fed balance sheet has acted to soak up excess dollars and thus acted to suppress consumer price inflation whilst boosting asset price inflation, however as noted elsewhere in this ebook it is gradually leaking or flooding back into consumer price inflation via mechanisms such as foreign capital flows. At the end of the day QE of $2.3 trillion will eventually translate into new fiat currency money supply of between $20 trillion and $40 trillion, in a gradual process of inflation leakage as U.S. CPI that inexplicably to the mainstream financial press trends ever higher. Throw in several more QE's and those numbers can be doubled yet again which illustrates the ticking inflation time bomb. If for whatever reason the Fed takes fright to the inflation monster it has created and suspends QE at or near current levels then that still would require QE to be unwound to eliminate the inflation monster that would still be enough to send U.S. CPI soaring as short-term interest rates rose. The net effect would be for the US bond market to plunge or even crash taking the dollar down by several notches with it - ALL INFLATIONARY. There really is no way out for the Fed, for if they continue QE its inflationary if they suspend QE and raise interest rates its still inflationary, hence Inflation is a ticking time bomb in the U.S. that WILL explode. PIMCO - has reportedly dumped all of its U.S. Treasury Bonds, in response to the expected end of QE, the Blogosfear ran and cried panic for stocks and more importantly bonds to imply that there will be no more QE! - Well that's not going to happen whilst large deficits exist that require the central bank (Fed) to monetize debt (buy government bonds). Instead, if Pimco and other bond funds are liquidating treasuries then where are they going to invest ? Yes I know they will likely hold a lot of cash as a stop gap, and apart from shorting treasuries which I have been advocating since August 2010, it seems obvious to me that instead of investing in bonds Pimco is going to invest in equities, as the always rear view mirror looking financial press will only see AFTER the fact - perhaps some 6 months down the road when perhaps the Dow has added on another 2k then the headlines will be PIMCO sold bonds to buy stocks ! Implication for stocks - Just as QE1 and QE2 were BULLISH (inflating asset prices) so will QE3 and after it QE4 that reinforces the primary bull market trend, for the U.S. will not stop printing money whilst the budget deficit remains anywhere near 10% of GDP (current approx 9%) and each time the U.S. announces another print run (QEx...) so it will imply ever higher future Inflation AND Interest Rates and so will weaken the U.S. Dollar (in relative terms because all fiat currencies are in free fall against one another), but not to worry asset prices are leveraged to real inflation courtesy of the likes of QE which means stocks should out perform loss of purchasing power. In terms of market timing, weakness ahead of the end of QE2 in June and into the no mans land before the announcement of QE3. So pay no attention to analysts / mainstream financial press and the Fed noises indicating an end to QE, instead keep your eye on the U.S. budget deficit as the most reliable indicator for future QE, and so I don't see why I should change my view that QE will run for the whole decade as the U.S. follows Japan towards debt at 200% of GDP (monetized courtesy of the Fed), though probably QE9 will be the straw that breaks the camels back. The U.S. Dollar Bubble Has Burst! Whilst the mainstream press talking heads continue to talk about bubbles everywhere except the biggest bubble of all which is the U.S. Dollar, that partially manifests itself in the USD index trending lower, though given the fact that all currencies are in free fall against one another the dollar bubble bursting is more evident in soaring commodity prices that are leveraged to real inflation. The US government and central banks are accelerating the trend for the destruction of the worlds reserve currency something that is more than evident in the rush into Gold and Silver as alternative currencies to fiat paper because they cannot be printed and therefore more difficult for the master manipulators at the Fed to manipulate lower as they have done so for US treasury yields which do not reflect the real US inflation rate that folks such as shadowstats put as high as 10% against official CPI of 2.7%. The bottom line is that the US is on an accelerating trend towards a dollar crash event when there is panic loss of confidence in dollars and by virtue of virtually every other currency will suffer to a great extent as all currencies are locked into a money printing death spiral towards oblivion, the only difference between currencies is the volatility in the differing rates of free fall which are the exchange rates that the financial press blandly reports on a daily basis. Now, everyone's apparently a dollar bear, though backtrack a few months to December 2010 with the USD Index breaking above 80 and the prevailing mood was turning decidedly bullish, with much talk in the financial press and blogosfear (ignoring dollar perma-bears) for the possibilities of USD rallying all the way to 90, which was not destined to happen as I commented upon at the time that it was a great time to load up with dollar shorts. My long standing USD analysis (12 Oct 2010 - USD Index Trend Forecast Into Mid 2011, U.S. Dollar Collapse (Again)? ) concluded in the following trend expectation for the U.S. Dollar into mid 2011 in that it targets a mid 2011 low of around 69-70. Currently the USD index stands at 73 which puts the trend firmly inline with the forecast expectations of over 7 months ago.

Here are a couple of quick examples of mainstream financial press expectations for the US Dollar for 2011. ABC News - 1st Jan 2011 - US Dollar Seen Rising in 2011 After Rough 2010 Never mind the lacklustre economy, the huge trade deficit or the government's piles of debt: The U.S. dollar is still expected to outperform most of the world's major currencies next year. "By all rights, the dollar should be declining in value, but it's not," says Eswar Prasad, economics professor at Cornell University. "For the dollar to decline in value, you must have currencies on the other side that will" rise. Bad as things are in the United States, they look worse in Europe and Japan, making the yen, the euro and the British pound riskier bets in 2011. A notable exception is the Chinese yuan, which is likely to rise next year as Beijing fights inflation. "The dollar remains the ultimate safe haven," Prasad said. FT - 7th Jan 2011 - Dollar rally finds fresh impetus Derek Halpenny at Bank of Tokyo-Mitsubishi UFJ said he expected the dollar to continue to outperform other main currencies regardless of the outcome of the employment report. “Our stronger bias for the dollar in 2011 is based on a number of factors, all of which are likely to result in an outperformance of the US economy relative to other major countries or regions,” he said. The Dollar's trend trajectory remains for USD index to nudge below USD70 by mid 2011 (June), the original expectations were for the dollar to rally from the new low point, which still stands as the most probable outcome given that a fall below USD70 will trigger an avalanche of dollar collapse / hyperinflation crash / expectations. I will revisit expectations for the USD index in an in-depth analysis for the remainder of the year during June. Events to Help Keep the Masses Sedated Whilst many vocally denounce the Fed as it plays smoke and mirrors with economic data so as to manage the populations inflation and economic expectations. However the Fed is an amateur when compared against other much older institutions. Several events during the week played their parts in keeping the masses sedated, In Britain, we had the Royal Wedding that was watched by near half the nation and many hundreds of millions more in former British colonies such as the United States, Canada and Australia. The workers of Britain and the U.S. are being squeezed by higher taxes and falling pay in real terms courtesy of high real inflation, so there's nothing like a FREE multi-national event to distract people from their economic plight. Meanwhile the Vatican conjured a miracle out of its magic hat as the current Pope beatified the preceding pope in response to an apparent miracle of a nun cured of Parkinson's (medical miss diagnoses?) following prayer to the preceding pope during 2005 (who suffered also from Parkinson's). There's nothing like the drug of a miracle that gives hope to millions of suffers and their families to fill church congregations and coffers, give the Fed a few hundred years and future Fed Chairmen will be similarly attired and held in just as much reverence as they announce the future miracle of QE free money. Obama Killed Osama? And lastly, the Sept 11th terrorist mastermind, Osama Bin Laden was apparently executed Sunday night (EST), coming as a surprise to many that he was still alive since many had concluded that he had probably died of kidney failure several years ago. On the news, celebrations broke out across America and right from President Obama downwards calls were heard of justice being served. Though I find it strange that justice can be served without a trial? Why Was Bin Laden's Body So Quickly Buried at Sea? The fact that his body was apparently quickly disposed of at sea smells very fishy to say the least. The whole event smells of a great stage managed propaganda piece that the mainstream media was more than happy to propagate. The facts are that an increasingly financially broke United States needs to withdraw from the costly Afghanistan occupation (as already announced by President Obama) and the primary reason for invading and occupying Afghanistan was to get Bin Laden, therefore it is timely for Bin Laden to be suddenly found, killed and quickly disposed of at sea therefore paving the way for the U.S. to say siagnora to Afghanistan, especially if the U.S. now has Iran in its sights hence a requirement to replenish and re-deploy military assets. It may well be that Bin Laden had already died several years ago of kidney failure and it was in U.S. geopolitical interests to keep Bin Laden alive up until the decision to withdraw from Afghanistan. Skeptical ? Remember that the Iraq War that has cost upwards of 100,000 lives was undertaken under the basis of Bush and Blair lies. As for President Obama, he played the ultimate patriot card Sunday night that no republican can match, a great way for him to start his re-election campaign with, as even republicans were singing his praises, given that there is speculation that the US has known of the compound for several years, perhaps the news breaking closer to the 10th anniversary of Sept 11th would have deemed to have been a little too suspicious. Source and Comments: http://www.marketoracle.co.uk/Article27904.html By Nadeem Walayat Copyright © 2005-2011 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of three ebook's - The Inflation Mega-Trend; The Interest Rate Mega-Trend and The Stocks Stealth Bull Market Update 2011 that can be downloaded for Free. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone this link To update your preferences this link How to Unsubscribe - this link

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. | ||||||||||||||

Sunday, 1 May 2011

May Home Buyer's Newsletter

at the end of the newsletter.

+++++++++++ May 1, 2011 +++++++++++++++++++

CONTENTS:

Introduction: Resale and New Sales Rise From February

Mortgage Rate Update: Rates Drop a Notch

This Month's Tip: Riding the Foreclosure Wave

++++++++++++++++++++++++++++++++++++++++++++

Introduction: Resale and New Sales Rise From February

Welcome to the May edition of the Home Buyer's Newsletter. Although

both new home and resale activity was up from the month of February,

both were down from their performance a year ago.

Sales of existing-home sales rose in March, continuing an uneven recovery

that began after sales bottomed last July, according to the National

Association of Realtors®.

Existing-home sales, which are completed transactions that include single-

family, townhomes, condominiums and co-ops, increased 3.7 percent to a

seasonally adjusted annual rate of 5.10 million in March from an upwardly

revised 4.92 million in February, but are 6.3 percent below the 5.44 million

pace in March 2010. Sales were at elevated levels from March through June of

2010 in response to the home buyer tax credit.

Lawrence Yun, NAR chief economist, expects the improving sales pattern to

continue. "Existing-home sales have risen in six of the past eight months,

so we're clearly on a recovery path," he said. "With rising jobs and

excellent affordability conditions, we project moderate improvements into

2012, but not every month will show a gain – primarily because some buyers

are finding it too difficult to obtain a mortgage. For those fortunate

enough to qualify for financing, monthly mortgage payments as a percent of

income have been at record lows."

Likewise, we saw in increase in new home sales figures from February to March.

Sales of new single-family houses in March 2011 were at a seasonally adjusted

nnual rate of 300,000, according to estimates released jointly on April 25th

by the U.S. Census Bureau and the Department of Housing and Urban Development.

This is 11.1 percent (±21.7%) above the revised February rate of 270,000, but

is 21.9 percent (±10.3%) below the March 2010 estimate of 384,000.

The median sales price of new houses sold in March 2011 was $213,800; the

average sales price was $246,800. The seasonally adjusted estimate of new houses

for sale at the end of March was 183,000. This represents a supply of 7.3

months at the current sales rate.

Although these sales figures are positive in the short term, they still continue

to be a challenge in the long term.

+++++++++++++++++++++++++++++++++++++++++++++

Mortgage Rate Update: Rates Drop a Notch

Mortgage rates dropped a bit during the month of April, largely due to bond market

pricing and several key economic reports. According to mortage company Freddie

Mac, 30-year fixed-rate mortgages stood at an average of 4.78% in the period that

ended April 28th after beginning the month at an average of 4.86%. 15-year fixed-

rate loans decreased to under 4.00% for the first time since early March with an

average of 3.97%. These rates began the month of April at an average of 4.09%.

Going forward, it is always a good idea to keep a close eye on Treasury Bond

yields as a fairly accurate barometer of trends that to a large degree convert

to the mortgage market.

For current average mortgage rates, see:

<A HREF="http://www.ourfamilyplace.com/homebuyer/rates.html">Mortgage Rates</A>

For an extensive discussion of all aspects of mortgages, see the section on the

site devoted to this subject. <A HREF="http://www.ourfamilyplace.com/homebuyer/mortgage.html">Mortgages</A>

++++++++++++++++++++++++++++++++++++++++++++++

Sponsor: Looking to Compare Agents? Try HomeGain.com

The most important part of your team for buying a home should be

your real estate Agent. Want to anonymously (and without obligation)

compare Agents? You can compare experience, background and

much more at HomeGain.com.

<A HREF="http://www.homegain.com/sp/ae_intro.html?entryid=2267&ht=houseclicksAE">Compare Agents</A>

++++++++++++++++++++++++++++++++++++++++++++++

This Month's Tip: Riding the Foreclosure Wave

Wherever you turn, the discussion on foreclosures is front and center. A direct

result of the housing crunch, the number of foreclosures has ballooned in the

last three years. Nationally, foreclosure sales have been running north of 30%

of all sales, which has a big effect on the overall market. In individual regions,

the foreclosure sales percentage is even higher, causing additional impacts in

those areas.

For a buyer entering the market at this time, the effects of the foreclosure

situation can be felt almost immediately, both in positive and negative aspects.

For buyers, the most positive perspective is in pricing. Large numbers of

foreclosures put a challenge on home prices not only because of competition,

but because the sellers--financial companies--have no emotional attachment to

the properties. Unlike homeowners who have years of memories and good times

in their home and won't "give it away," generally these sellers single goal

is to get the property sold as quickly as possible. And that almost always

converts to pricing pressure.

Another positive aspect is the amount of inventory available. In some areas,

there are more homes available now than there have been for years. This

not only gives the buyer more options for their purchase, but because of

the competition, puts additional pricing pressure on the market.

Like so much in life, though, what makes something good can also make it

bad. Lower prices and more choice can be double edged swords. If prices

remain low (or continue to erode) for the near future, then it becomes

more difficult to gain equity in the home, which is one of the primary

benefits of home ownership. This also could be a potential problem if

the need arises to sell the home in a few years, before a price recovery

has occurred.

Another potential downside to purchasing foreclosures concerns the condition

of the properties. Although some foreclsosures are in reasonably good

shape, many have had maintenance and repairs neglected, largely due to

lack of funds with the previous owner. Also, it is not unusual to

see foreclosures that have had many items (such as stoves, diswashers,

and lighting and plumbing fixtures) removed from the property. This

obviously puts a burden on the home buyer since replacements will need

to be purchased before the house becomes habitable.

It is important to also be aware that in virtually all cases, the seller

of a foreclosure will do absolutely nothing in the way of repairs. A

buyer may attempt to protect themselves by securing a whole home

inspection, but if the report is negative, the costs would need to

be wholly borne by the buyer. This can turn what appears to be a

reasonable price to one that is wholly unacceptable.

Can a great deal be made on a foreclosure? Absolutely. Is it a

slam-dunk proposal? Absolutely not. If you think you may have an

interest in purchasing one, it is very important that you educate

yourself on the following:

1) The state and health of the market in your area

2) The state and number of foreclosures in that area

3) The foreclosure sales process

4) Any legal aspects of buying a foreclosure (e.g., deeds)

Working with an Agent who has experience in foreclosure purchases

(rather than sales) can be an invaluable asset in the process.

Next Month's Tip: Using All the Resources Available

++++++++++++++++++++++++++++++++++++++++++++++

The Home Buying Checklist

Many of our visitors have said that one of the most valuable

aspects of the Home Buyer's Information Center is the

Buying Checklist, where they can make sure that all

the bases have been touched. You can find the checklist

here: <A HREF="http://www.ourfamilyplace.com/homebuyer/checklist.html">Home Buyer's Checklist</A>

As always, if you have suggestions for improving the

site, or topics you would like to see addressed in

this newsletter (or, if you have used the Home Buyer's

Information Center to successfully purchase a home),

drop us a quick line here:

<A HREF="http://www.ourfamilyplace.com/homebuyer/feedback.html">Home Buyer's Information Center Feedback</A>

A special thanks to all those who have written to let us know

that they have found the Home Buyer's Information Center a

helpful resource in their buying process.

Have a great month and good luck in all your endeavors!

The Team at the Home Buyer's Information Center

_____________________________

Change email address / Leave mailing list: http://ymlp110.net/u.php?id=gumyqmbgsgbbmwgbw

Powered by YourMailingListProvider

The mainstream financial press appears to flip flop on its expectations for the prospects for UK interest rates virtually every other week. Just over a month ago in March, the mainstream financial press had collectively convinced themselves that a May rate rise was virtually a done deal, then having failed to materialise the press flopped to expect no rate rise for the remainder of the year, now after heard Merv's Inflation fears statement they are again flip flipping for an early rate rise.

The mainstream financial press appears to flip flop on its expectations for the prospects for UK interest rates virtually every other week. Just over a month ago in March, the mainstream financial press had collectively convinced themselves that a May rate rise was virtually a done deal, then having failed to materialise the press flopped to expect no rate rise for the remainder of the year, now after heard Merv's Inflation fears statement they are again flip flipping for an early rate rise.