Bank of England Cancels Britain's Debt, Budget Deficit Crisis is Pure PropagandaStocks Stealth Bull Market 2011 Ebook Direct Download Link (PDF 2.8m/b) Interest Rate Mega-Trend Ebook Direct Download Link (PDF 2.3m/b) Inflation Mega-Trend Ebook Direct Download Link (PDF 3.2m/b) Dear Reader The focus of this article is on Britains debt dynamics as the people of Britain continue to be bombarded with propaganda in respect of the unfolding Inflationary Depression that the country has been immersed in since at least early 2008. In terms of politics, propaganda takes the form of declarations for ever greater needs for economic austerity by the Coalition government whilst the Labour party as usual takes the opposite line, when the reality is that there has been no real net economic austerity in Britain, as there has been no cut in government spending and hence the deficit continues to persist let alone any actual repayment of debt that continues to expand by about £120 billion per year. Meanwhile the Bank of England continues to play its role in the economic propaganda war by playing the always imminent deflation card that is regurgitated at length by academics and pseudo economists in the mainstream press when the reality is that the UK as is the case for most western nations such as the US is immersed in an exponential inflation mage-trend that results in the stealth theft of wealth to finance government spending for the purpose of buying votes. Britain's Economic Austerity / Debt / Deficit Reduction Propaganda The Coalition Government as illustrated by the Prime Minister, David Cameron's series of speeches re-iterating the UK governments efforts towards cutting the governments budget deficit, and actual repayment of debt before the end of this parliament (2015) for which there is an ever present need for economic austerity which translates into deep cuts in government spending - David Cameron - 10th October 2012

Fact - No Debt has been repaid, Instead UK government debt continues to accumulate at the SAME rate as it would have done under a Labour government.

Of course total government debt is actually over X4 higher then official public debt at about £4.8 trillion for 2012-13, which is set against my forecast of May 2009 of £4.7 trillion for 2013.

In additional to public debt and liabilities there is also private sector debt of banks, corporations and individuals that is estimated to be between £6 to £8 trillion, given the fact that the bankrupt banks alone are still sitting on approx £4 trillion of debt, thus total UK debt is estimated to be between £11 and £13 trillion. Is the Coalition Government Cutting the Deficit as It repeatedly States? With the focus on official government debt (PSND) i.e. excluding the £1 trillion banking sector bailout, the below updated graph illustrates how the annual deficits are turning out when set against the Governments own forecast of June 2010 (OBR), and similarly my forecast of the same month (UK ConLib Government to Use INFLATION Stealth Tax to Erode Value of Public Debt )

What the graph clearly shows that the UK government has once more LOST control of the budget deficit, because instead of the deficit falling to around £90 billion for 2012-13, the government will be luckily if the deficit comes in under £130 billion. Furthermore this trend for expanding deficits is expected to persist going into the May 2015 election as the Coalition government ramps up government spending to buy votes, therefore there is a high probability that the deficit could yet expand further, the net effect would be for a total accumulative additional budget deficit of well over £200 billion more than government expectations. UK Debt to GDP Ratio The following graph illustrates the difference between the Government's Debt to GDP trend expectations and the real debt dynamic reality (excluding bank bailouts) of out of control budget deficit, the government forecast, and my original expectations of June 2010.

The graph has been updated to show my expectations for Debt to GDP to rise to 79% by 2015-16 as a consequence of persistently high budget deficits that look set to average £110 billion per year, instead of £80 billion per year. Government Spending - The NHS is Bankrupting Britain The government is set to spend an estimated £683 billion for the current financial year 2012-13, that is currently running an ANNUAL £128 billion deficit, i.e. the government will this year spend £128 billion more than it earns in revenue which is contributing to towards Britains inflationary depression. My analysis of October 2010 (UK Public Sector Spending Cuts Impact on Deficit, Debt, Unemployment and Economy)forecast that government spending would continue to grow to £739 billion by May 2015 and so far the Government in the preceding TWO years has done nothing in terms of cutting government spending to alter this trend trajectory despite all of the cuts propaganda to date.

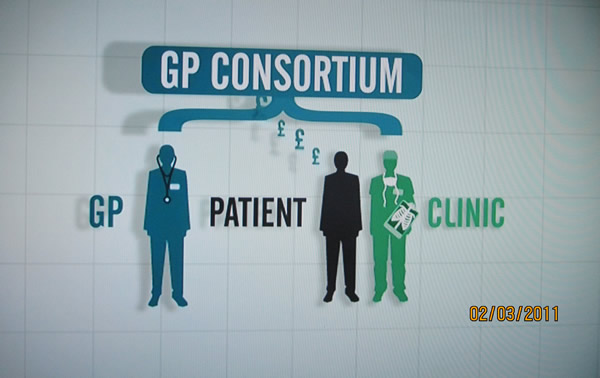

The NHS is the Governments largest departmental expenditure, for instance NHS spending now stands at £127 billion (2012-13) and remains on target to expand to at least 140 billion for 2014-15. The NHS budget under Labour had grown from £40 billion in 1997 to £120 billion by the time of the 2010 General Election. NHS budgets increasing in line with inflation (CPI) would have seen the budget rise to stand at £51.6 billion, and probably nearer £60 billion to allow for an ageing population. So the Labour government in effect spent an extra £60 billion a year. Against this extra spending instead of Briton's experiencing the health benefits of effectively paying for TWO NHS's, the NHS has experienced year in year out loss in productivity, i.e. the more the government spends on the NHS the LESS output the NHS delivers as more tax payer funds disappear into the NHS black hole. In theory this suggests that the NHS budget could in-effect be halved to back towards £60 billion and still deliver a functional health service that the country could actually afford. Off course that is not going to happen, but still a mere 10% cut in the NHS budget would contribute some £12 billion of annual savings from what amounts to an out of control spending black hole that like a cancer is eating away at the British economy. However, both major political parties stubbornly stick to the policy of not only not cutting spending on the largest spending departments of Education or the NHS but seeking to continue to GROW these budgets over the coming years. Similarly both parties have pledged to grow pensions and neither can I see how welfare can be significantly cut as unemployed will remain unemployed until they get a job. Furthermore debt interest at £50 billion per year is expected to continue to grow inline with each month the government racks up another large deficit, which therefore adds to the annual government spending totals. Government spending at approx 20% more than revenue (£128bn/ £383bn) continues to represent out of control spending that risks severe consequences, including state bankruptcy i.e. debt default. In response to this politicians of all parties continue to lie for the duration of the current parliament by repeatedly failing to identify where and how this deficit will actually be cut. NHS GP Doctors Putting Profit Before Patient Care, Channel 4 News InvestigationDuring 2011 a Channel 4 News investigation illustrated Coalition Government incompetence by charging NHS Doctors with the subversion of the the coalitions governments NHS reforms to result in NHS doctors pocketing all of the cash saved as a consequence of the reforms, which matched my own analysis of a year earlier that the Coalition Governments proposed reforms were fatally flawed in that they allowed GP's to profit from patient care. "Your doctor making a profit out of your health care, your GP Sending you to a clinic that he or she owns shares in, we are seeing the biggest shake up of the NHS in its history, Channel 4 news can reveal tonight that there is nothing on the legislation currently before parliament to prevent the outcome no one wants, doctors putting profit before the care of patients, in our special report tonight we show how the new arrangements will create fundamental conflicts of interest potentially harming the trust at the very heart of the doctor patient relationship". Channel 4 News Channel 4 News investigation key points:

Under the previous Labour government patients were treated as credit cards to swipe in and out of door ways as fast as possible to maximise profits. Under the Coalition government patients will now become cash cows to milk to the fullest extent possible, what's best for the health of patients won't even factor into the thought process during GP consultations - "If I send Patient X to Clinic Y for Operation Z, my consortia will earn a commission of £2,000". Sheffield NHS GP Consortia's Example The city of Sheffield illustrates how the implementation of Coalition government reforms is proving to result in the exact opposite anti-competitive consortia's, as virtually all of the Sheffield NHS 92 GP Practices have signed up with one of of 4 geographically located GP Consortia's.

The NHS GP reforms being implemented are pushing towards the worst of both worlds, i.e. no market competition and unprecedented GP control over NHS funds that in significant part will be funneled into the back pockets of NHS GP's via Consortia profits being paid out as dividend's to GP partners and eventual huge windfall profits of several million pounds per GP as consortia's are floated onto the stock market. Public Sector Noose Tightens Around UK Economies Neck The Public sector comprises some 50% of the economy that acts as a noose around the economy that strangles competitive industries and entrepreneurship, because one cannot compete against subsidised public sector services that exist purely to accumulate debt. Many may argue the case for economic austerity reducing the size of the public sector, however all that has happened is that services have been slashed in an attempt to retain as many of the public sector jobs as possible, thus leaving diminished funds for actual front line services. The Perpetual Debt Inflation Based Economy The only answer / solution that governments have remains as I have iterated many times over the past few years, that for the stealth default by means of high real inflation, and hence the Inflation Mega-trend. Inflation is a REQUIREMENT for the Debt Based Economy, this is how governments keep putting off the day of reckoning by inflating the debt away and then borrowing more money to service the debt interest which is why virtually all money in an economy is debt money that will NEVER be repaid. When George Osbourne and David Cameron are telling you that they are paying down Britain's debt, they are LIEING! NO GOVERNMENT DEBT IS BEING REPAID OR WILL EVER BE REPAID! You should by now be realising that the over-whelming commentary about the threats and risks of debt deflation are nothing more than propaganda so as to allow policies such as quantitative easing (money printing) to be more palatable to the general populations so as to ensure that the Inflation Mega-trend continues, therefore a good 90% of what you read in the mainstream press which is regurgitated by the blogosfear is pure propaganda. The Quantum of Quantitative Easing It is time for another one of my Red pills (your choice), but be warned this time I am going to take you even further down the rabbit hole than is usually the case.

This is where we once more leave behind academic analysis of UK debt that the mainstream financial press and which government propaganda / politicians focus upon, but instead take a look at what is really going on with regards Britain's debt dynamics, because the picture we get is very different to the one I have just extensively painted above when we bring what I termed as the Quantum of Quantitative easing into the picture ( 20 Jul 2012 - The Quantum of Quantitative Easing Inflation is Coming! ). What is the Quantum of Quantitative Easing (QQE) ? First a reminder of QE, to date the Bank of England has officially printed QE of £375 billion, plus another £80 billion that goes by the name of funding for lending, plus at least another £50 billion of behind the scenes off balance sheets loans to the Bankrupt banks that date back to as long ago as April 2008 that are continuously rolled over which means that the total QE is at least £505 billion of which approx 75% is being utilised to to buy UK government bonds. My article of July 2012 explained that QQE amounts to the effective cancellation of government debt as the Bank of England repays the interest received on the debt held by the Bank of England back to the government..... By Nadeem Walayat Copyright © 2005-2012 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of three ebook's - The Inflation Mega-Trend; The Interest Rate Mega-Trend and The Stocks Stealth Bull Market Update 2011 that can be downloaded for Free. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone this link To update your preferences this link How to Unsubscribe - this link

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. | ||||||||||||||

DSD Removals and Storage

Monday, 3 December 2012

Bank of England Cancels Britain's Debt, Coalition Government Budget Deficit Crisis is Pure Propaganda

Subscribe to:

Post Comments (Atom)

Its a nice blog. I have a good new for any one that is Removals in Kingston.

ReplyDeleteI was looking for this certain information about removals for a long time. Thanks for sharing…

ReplyDeletemovers and packers hyderabad.